According to the United States International Trade Commission (USITC), many US firms are eyeing Vietnam’s lucrative telecom industry, such as AT&T, CenturyLink, GTT Communications, Level 3 Communications, Sprint, and Verizon.

USITC said in its report “TPP Agreement: Likely Impact on the US Economy and on Specific Industry Sectors” released in late May, that these firms wanted Vietnam to lift or, ideally, remove foreign equity caps and restrictions that were likely to deter US carriers from establishing or expanding their operations in the country.

If these firms expand their business to Vietnam, they would also help Vietnam in luring more foreign telecom services.

“American telecom companies are some of the most sophisticated and competitive in the world. This is only one of many economic sectors where US firms see opportunity in Vietnam,” Adam Sitkoff, executive director of the American Chamber of Commerce in Hanoi, told VIR.

“As the country’s telecom sector opens-up, Vietnamese consumers will enjoy greater choice, higher quality services, and more competitive pricing.”

For example, in a bid to take advantage of Vietnam’s telecom market opportunities, the US’ DASAN group would intensify its operations here.

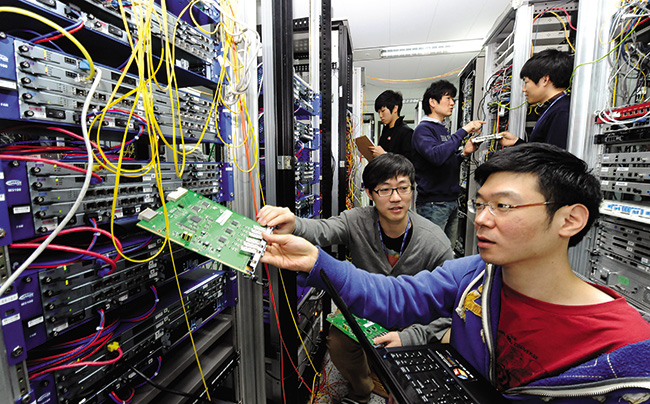

Min Nam Woo, chairman of DASAN Networks Solutions, the US-based company recently agreed to a merger with another US-based company, Zhone Technologies, to become DASAN Zhone Solutions, told VIR that this year, DASAN would “double” its research and development (R&D) workforce in Vietnam, to better serve its clients worldwide. Currently, DASAN has an established R&D lab in Hanoi.

“DASAN will pave the way for the development of a highly skilled labour force in Vietnam, especially in electronics and engineering. As a US company we can assist local telecommunications carriers in their plans to expand to the US market, one of the most lucrative markets in the world,” Woo said.

Vietnam’s telecom market was worth $7.4 billion in 2013, which is forecast to grow by 144 per cent in 2018.

The industry is currently controlled by three giants, VNPT, MobiFone and Viettel, with the total mobile subscriber number of 138 million. Still, under the Trans-Pacific Partnership (TPP) commitments, Vietnam will have to gradually open the industry’s door to the agreement’s 11 member countries.

Specifically, facilities-based basic services in Vietnam are permitted only through a joint venture (or with the purchase of share in a Vietnamese enterprise), with foreign equity limited to 49 per cent.

Facilities-based value-added services are permitted only through a joint venture (or purchase of shares in a Vietnamese enterprise with foreign equity limited to 51 per cent), and foreign equity of up to 65 per cent will be permitted no later than five years from the TPP’s entry into force.

Also, non-facilities-based basic and value-added services are permitted only through a joint venture (or purchase of shares in a Vietnamese enterprise) with foreign equity limited to 65 per cent, or 70 per cent for virtual private networks.

Foreign equity limitations and joint venture requirements will be eliminated no later than five years after the TPP’s entry into force. Facilities-based carriers own and operate the network(s) over which they offer telecom services, whereas non-facilities-based carriers lease such networks.

According to USITC, certain provisions in the TPP’s state-owned enterprises (SOEs) chapter are also relevant to US enterprise service providers, particularly those interested in entering Vietnam, as the telecom service markets of Vietnam are dominated by state-owned service providers.

Beneficial provisions include those that require telecom sector SOEs to compete on the basis of quality and price, rather than through commercial and regulatory discrimination, subsidies, and favouritism.

The chapter’s provisions will allow US telecom companies to bring enforcement actions against SOEs that engage in discriminatory behaviour.